Blog de Red Hat

The beginning of any new year is a time of reflection for many IT departments across industries and organizations big and small. At Red Hat, this means it is time once again to hear directly from our customers what is top-of-mind for their business in the new year. We surveyed more than 400 Red Hat customers from around the globe about their 2018 priorities, including top challenges, budget allocation, cloud deployment strategies, and plans for emerging technologies.

Last year’s survey revealed that most respondents were on the digital transformation journey and looking to shift their investments to modern infrastructure and applications. The Red Hat Global Customer Tech Outlook 2018 saw a bit of a shift from previous years, however, and some findings highlighted respondents’ mindshift towards doing more with existing IT investments, while others exemplified the role cloud initiatives are playing within organizations.

Here’s what we learned from the Red Hat Global Customer Tech Outlook 2018:

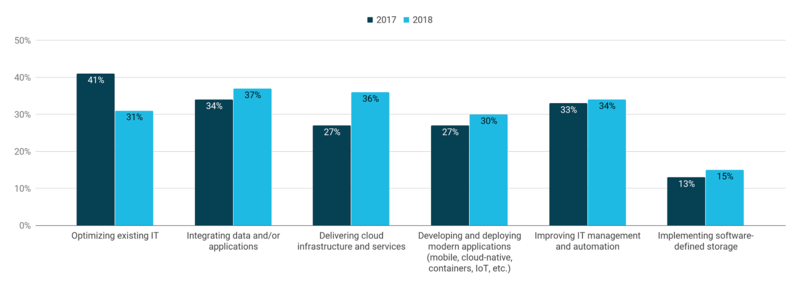

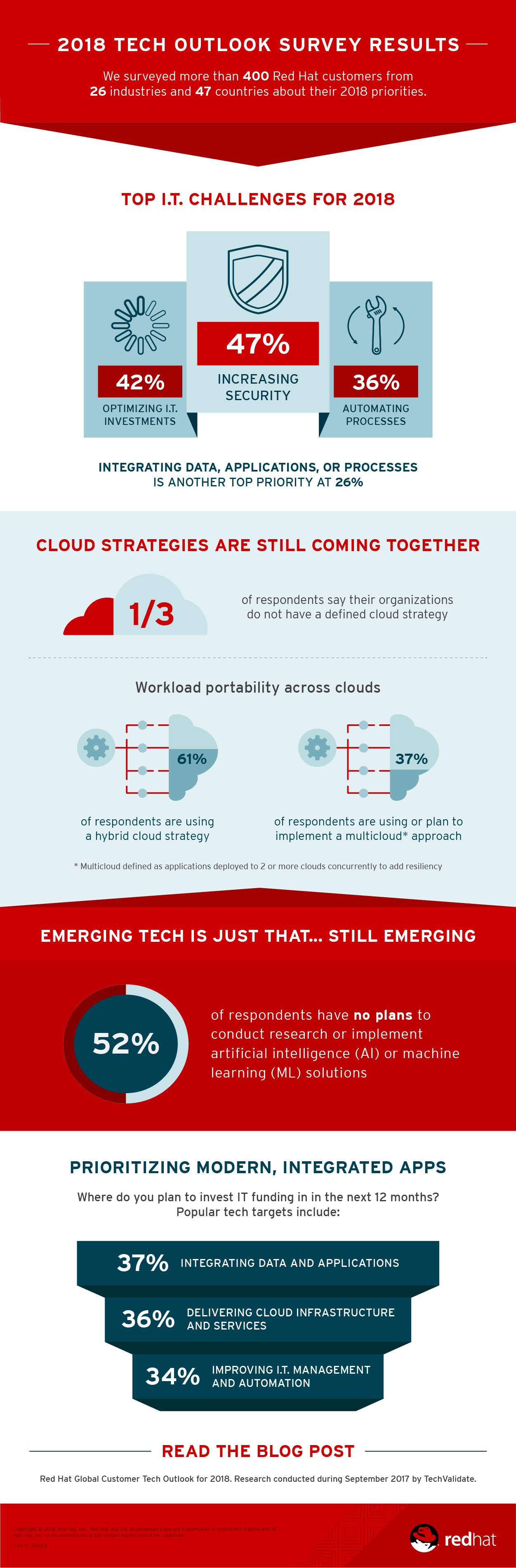

IT spend is shifting: While spend in 2017 focused on optimizing existing IT, most respondents are planning to spend more of their budgets in the following areas: delivering cloud infrastructure and services (36%); integrating data and applications (76%); and developing and deploying modern applications (30%).

Cloud initiatives are expected to continue growing and maturing in 2018: As in 2017, funding for cloud infrastructure was cited as a top focus for investments among survey respondents in 2018 (36%), with hybrid and multi-cloud favored. Most organizations surveyed (61%) also now define their cloud infrastructure strategies as hybrid, as compared to last year, when it was a split between hybrid (30%) and private (38%).

While hybrid cloud is the hot strategy, some respondents are still going beyond hybrid coordination to workload portability across more than one cloud concurrently, using multi-cloud strategies for their apps. About 37% of responding organizations are moving towards a multi-cloud future, either deploying or planning to deploy a multi-cloud infrastructure in 2018.

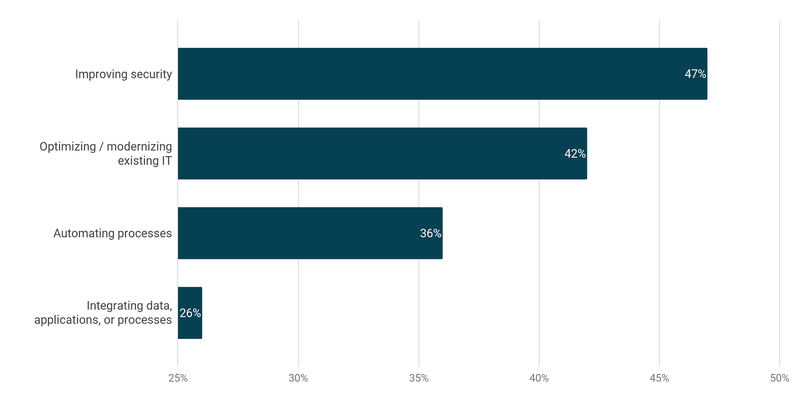

Modernizing existing IT investments still a top challenge (and priority) for many: While most organizations were tackling digital transformation according to our 2017 survey, this year one priority for many respondents is addressing the challenges associated with optimizing and modernizing existing IT investments, which 42% of survey respondents ranked as a top challenge in 2018. Additional top challenges include improving security (47%), automating processes (36%), and integration of data, processes and apps (26%). Additionally, 31% of respondents consider modernizing existing IT investments a funding priority this year.

As we reviewed the results, a couple in particular surprised us:

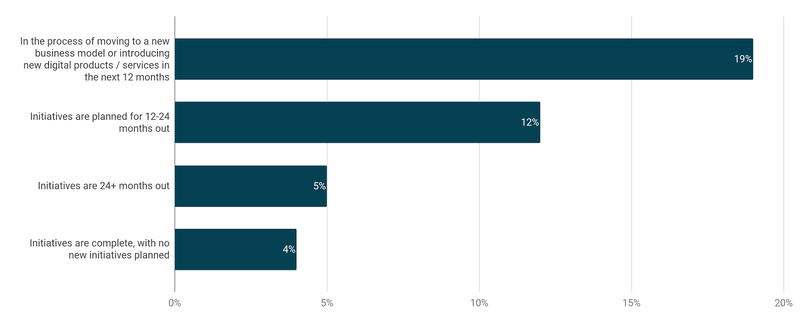

Modernize first, transform second -- OR digital transformation by any other name? Everyone is talking about digital transformation, but are most organizations executing on those initiatives? Surprisingly, our data showed that only 19% of respondents plan to execute on digital transformation initiatives in 2018. Because “modernizing existing IT” remains a top challenge (42%), we believe this shows that respondents are focusing on optimizing those investments and creating a more agile infrastructure before moving ahead with full digital transformation. That said, we also see evidence that organizations are implementing the building blocks of digital transformation—with investments in integration, cloud infrastructure, and modern apps. This is perhaps a good indication that among enterprise customers, this is simply how they are delivering more modern services now—no transformation tag needed.

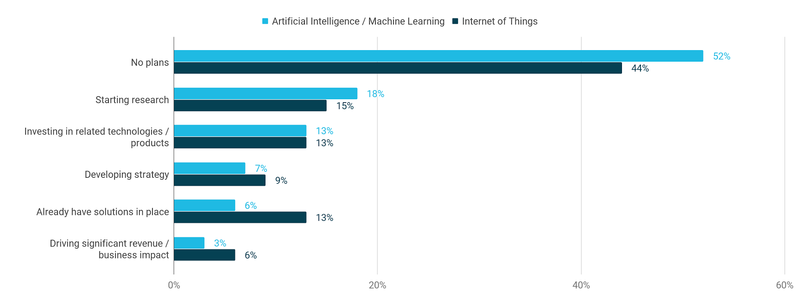

Emerging technologies are just that—still emerging. Over 50% of respondents reported they have no plans to conduct research or implement artificial intelligence (AI) or machine learning (ML) solutions in 2018. A little over 40% said the same of the Internet of Things (IoT). For most IT organizations, these emerging technology areas are still emerging and not a top priority in 2018. As upstream open source innovation advances these areas, we expect to see adoption plans follow suit in future surveys.

We’re entering 2018, and for many organizations, cloud strategies are still coming together. One-third of respondents say their organizations do not have a defined cloud strategy. This may be an indication that enterprise customers are still carefully watching the ever-evolving cloud landscape. For IT leaders who have defined their organization’s cloud strategy, we see this as an indication that they may need to more clearly articulate that strategy across their organizations.

We’ve pulled together an infographic on all of the results of the Red Hat Global Customer Tech Outlook 2018 below. Check it out or download here.

Methodology

Red Hat conducted an online survey in September 2017 using TechValidate of a pool of Red Hat customers about their tech priorities and insights moving into 2018. Respondents were from all over the globe, representing the following regions: Asia Pacific; Europe, Middle East, Africa; Latin America; and North America. The largest percentage of respondents were from large and medium enterprises (53.5%), with the remaining respondents from small businesses (16%); Global 500 companies (10.9%); educational institutions (4.9%); state & local governments (4%); Fortune 500 companies (4%); S&P 500 companies (2%); non-profit, membership organizations, and foundations (2%); and federal government (1.8%). Respondents represented the following industries: computer software, hardware, and services (19.2%); financial services (10.2%); telecommunications (9.2%); government (7.3%); healthcare (6.2%); educational institution (6%); energy and utilities (5.7%); retail (5%); media and entertainment (4%); aerospace and defense (3.8%), industrial manufacturing (3.6%); electronics (3.3%); transportation services (3.1%); automotive and transport (2.6%); professional services (2.6%); non-profit, foundation, and membership organizations (2.4%); consumer products & services (1.7%); food and wholesale distribution (.007%); security products and services (.007%); agriculture (.004%); chemicals (.004%); construction (.004%); environmental services and equipment (.004%); metals and mining (.004%); engineering (.002%); and real estate (.002%).

Note: Numbers may not add up to 100 percent due to rounding.

Sobre el autor

Red Hat is the world’s leading provider of enterprise open source software solutions, using a community-powered approach to deliver reliable and high-performing Linux, hybrid cloud, container, and Kubernetes technologies.