Blog da Red Hat

The new normal in banking increasingly includes digital self-service, as customer expectations and demands have increased with the “consumerization” of banking on multiple devices.

Highly available digital products and services are dependent upon flexible distribution channels used to meet the banking needs of customers. Indeed, it requires more than an interactive interface.

Banking leaders surveyed in a Harvard Business Analytic Services report, sponsored by Red Hat, say they can't rely on more and more layers of customization to legacy core systems to provide the data and adaptability they now need.

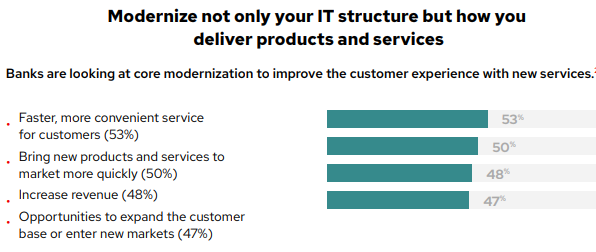

Eighty percent of those banking leaders surveyed responded that they plan to invest in core system modernization over the next year to provide faster, more convenient service for customers (53%) and bring new products and services to market more quickly (50%).

Often decades old, banking cores are becoming increasingly difficult and costly to maintain, and are approaching limits on incremental functionality enhancements. With more demands placed on the core for modern functions, like real-time transactions and personalized financial services, heritage systems are often struggling to keep up.

Often decades old, banking cores are becoming increasingly difficult and costly to maintain, and are approaching limits on incremental functionality enhancements. With more demands placed on the core for modern functions, like real-time transactions and personalized financial services, heritage systems are often struggling to keep up.

The path forward - weighing the risks and rewards

Banks must weigh the risk of changing core systems to improve the business against the need to drive the business forward, which includes reducing IT complexity and cost. A modernization strategy unique to the bank’s objectives that also considers the existing technology footprint can take different forms.

This includes extending existing mainframes to be cloud-enabled, renewing core systems with modern cloud-native solutions, or reinventing core systems altogether—perhaps even as a new brand. In any approach, it’s important to illustrate the ROI achieved in phases to help continue support for the ongoing journey – building upon incremental successes as a more progressive strategy to core system updates.

How are banks moving forward?

In the survey, 70% of respondents reported they are planning to purchase new systems from a core banking technology provider, while 39% plan to build new core systems in-house, an indication that a portion of banks are taking a hybrid approach.

When that is considered, along with 91% citing they are pursuing a platform based business model1 as a longer term objective, the steps taken in the early journey will impact the ease of executing strategy later on. The importance of flexibility, along with investment optimization to address immediate and near term needs - coupled with longer term strategic goals - brings the significance of the choice of foundational infrastructure technology for core banking modernization to the forefront.

Red Hat can help - independent of your stage in the transformation effort

Red Hat helps simplify core banking modernization with enterprise open source infrastructure that is engineered to access modern methodologies and transform at scale - in whatever step of your journey you may be in. With an open source approach that facilitates core banking modernization, banks can better manage innovations to the software stack.

This applies whether modernizing the mainframe to the cloud to accelerate time to market - including containerized cloud native integration bridging renewed systems with heritage systems - or as a cloud-native microservices architecture for containerized core business services. Red Hat OpenShift and cloud-native tooling can help banks adapt to the volatility of digital demands by supporting data insights for personalization, offering a consistent cloud experience that considers data sovereignty requirements, and helping extend the versatility of infrastructure support teams by providing the opportunity to expand skillsets.

With Red Hat and our core banking system partners, your modernization can be more portable, to address current and future needs.

We invite you to read the entire HBR Analytic Services survey, Modernizing Core Systems Has Become a Business Imperative for the Banking Industry, or explore Red Hat’s financial services solutions for more perspectives.

Sobre o autor

Described as a pioneer and one of the most influential people by CRMPower, Fiona McNeill has worked alongside some of the largest global organizations, helping them derive tangible benefit from the strategic application of technology to real-world business scenarios.