In this post:

-

Get an overview of how organizations in the Financial Services and Banking sector have progressed and invested in their digital transformation initiatives.

-

Learn the factors driving acceleration in digital transformation efforts within the Financial Services and Banking sector.

Red Hat’s yearly survey, the 2022 Global Tech Outlook report, consolidated industry input and responses to questions related to digital transformation efforts across industry categories.

In this article, we’ll look at some key takeaways in the report from the Financial Services and Banking sector. Among the areas cited to help attain an effective digital transformation strategy in Financial Services and Banking included closing talent gaps, accelerating application development, and establishing a hybrid cloud platform.

Methodology and scope

Red Hat surveyed cross-industry respondents to gain insight on changing trends surrounding digital transformation efforts. Conducted during the latter half of 2021, the report includes responses from 1,341 information technology (IT) leaders and decision makers—including those from companies with more than US$100 million in annual revenue.

The intent was to gain understanding on their digital transformation journeys, including the commitments they intend, or already have initiated, in their IT funding priorities, and the types of infrastructure on which they are running applications. The respondents represent a broad mix of organizations—including Red Hat customers—across geographies.

Let’s dive into how organizations in the Financial Services and Banking sector have progressed and invested in their digital transformation initiatives.

Transformation efforts accelerating in Financial Services and Banking

Participants within the Financial Services and Banking sector were asked to identify the stage in which they classified their digital transformation efforts, as defined below:

-

Leading - Well into the transformation process and have seen successful outcome(s).

-

Accelerating - Increasing efforts to utilize innovative processes.

-

Transforming - Using new processes to innovate and transform how we work.

-

Emerging - Starting to adopt new processes.

-

Stalled - Initial investigation and research, but no further action.

-

Not yet started or just beginning - Doing some initial investigation and research.

-

No plans

Their 2021 responses revealed demonstrated progress toward new approaches to create better business outcomes by people, processes and technology.

Compared with the overall industry in the “Leading” and “Accelerating” categories, their responses were 18% versus 14% , and 25% versus 22%, respectively. The sector was near the top in the “Transforming” category as well, reporting a 30% response.

Factors driving acceleration in digital transformation efforts within the sector include:

Factors driving acceleration in digital transformation efforts within the sector include:

Motivators driving transformation efforts

When asked for a word that would describe their top priority in their digital transformation efforts, Financial Services and Banking respondents remained relatively consistent in the top-cited categories of innovation, security, and experience (user). Upticks in speed of product delivery, availability of skill sets, and improvements in the end user experience showed increases over the previous year.

We can infer from the survey that organizational priorities shift depending on where organizations classify themselves in the different stages of digital transformation initiatives. Organizations in earlier stages were more likely to focus on cost reduction and simplification, but those in the emerging and other later stages—including the financial sector—most often chose innovation as their top priority.

Many digital transformation projects may start as IT efficiency efforts, but become crucial in improving competitiveness, revenue growth, and customer experience.

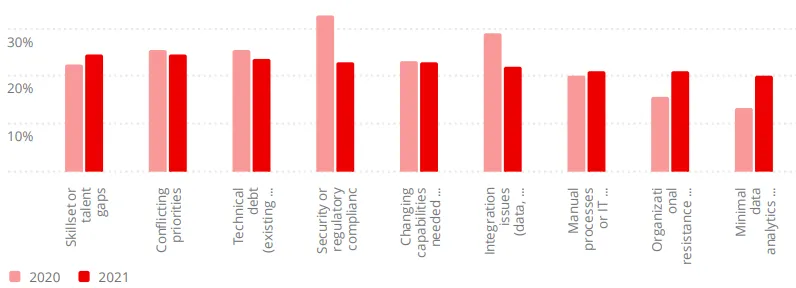

Respondents are also aware that challenges exist to obtain these benefits, with perceived obstacles in both technical and operational categories.

Cloud implementation strategies and security prioritization

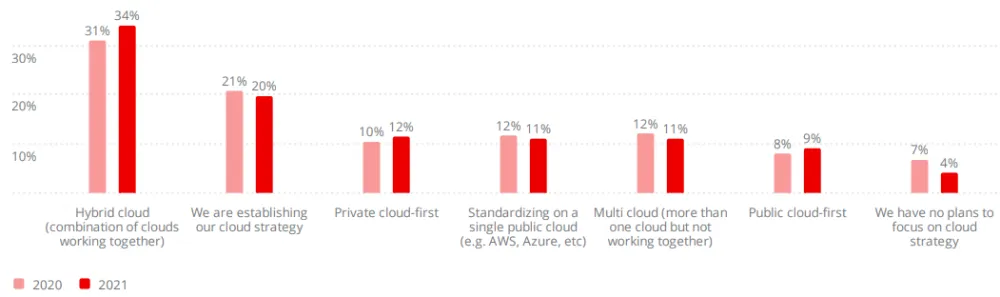

In the Financial Services sector, the hybrid cloud strategy continues to climb—growing 3% from 2020—and is nearly three times as common as the next implementation, which is private cloud (34% versus 12%). A number (20%) of organizations are still establishing a cloud strategy, and a noticeable drop (7% versus 4%) was observed in organizations having no cloud strategy plans in 2021.

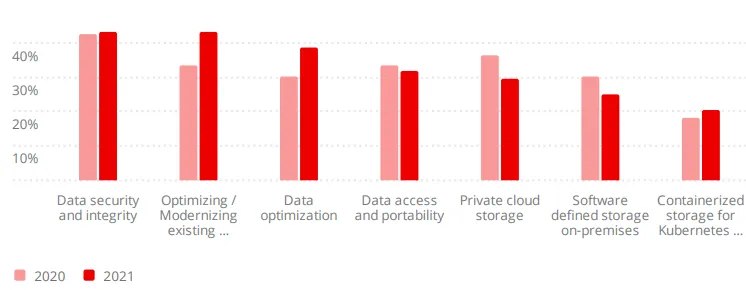

The 2021 survey suggests that Financial Services and Banking decision makers are generally focused on addressing a variety of needs, including prioritizing security, modernization, data optimization, cloud management and hybrid cloud infrastructures.

Of particular interest, security is consistently top of mind and is echoed by survey participants.

Polled within the security category, Financial Service professionals cited cloud security, data protection, and threat intelligence and detection as top concerns. Network security remains the highest security funding priority at 38%, with cloud security close behind at 37%. Vulnerability management saw a sizable increase in prioritization since last year as depicted below.

Learn more

There is a wealth of additional insight in the report, including use of emerging technology, automation and more. Read the full 2022 Global Tech Outlook to learn more about how enterprises across industries are planning to modernize their IT approach and strategies in the coming year.

More data on enterprise open source in the financial industry is contained in our The State of Enterprise Open Source infographic. Check out how Red Hat is helping financial services organizations keep pace at pace here.

À propos de l'auteur

Plus de résultats similaires

KServe joins CNCF as an incubating project

Bringing intelligent, efficient routing to open source AI with vLLM Semantic Router

What’s The Recipe For Burnout? | Compiler

GitOps with Argo CD | Technically Speaking

Parcourir par canal

Automatisation

Les dernières nouveautés en matière d'automatisation informatique pour les technologies, les équipes et les environnements

Intelligence artificielle

Actualité sur les plateformes qui permettent aux clients d'exécuter des charges de travail d'IA sur tout type d'environnement

Cloud hybride ouvert

Découvrez comment créer un avenir flexible grâce au cloud hybride

Sécurité

Les dernières actualités sur la façon dont nous réduisons les risques dans tous les environnements et technologies

Edge computing

Actualité sur les plateformes qui simplifient les opérations en périphérie

Infrastructure

Les dernières nouveautés sur la plateforme Linux d'entreprise leader au monde

Applications

À l’intérieur de nos solutions aux défis d’application les plus difficiles

Virtualisation

L'avenir de la virtualisation d'entreprise pour vos charges de travail sur site ou sur le cloud