Modernize your insurance platform with Red Hat OpenShift AI

For insurers, modern risks are increasingly intricate, interconnected, and capable of causing catastrophic losses. As defined by the World Economic Forum, these risks are hard to predict, highly complex, and potentially systemic, leading to significant financial instability if not managed proactively.² Each of these external threats pressures insurers to transform their technology and the thinking around it.

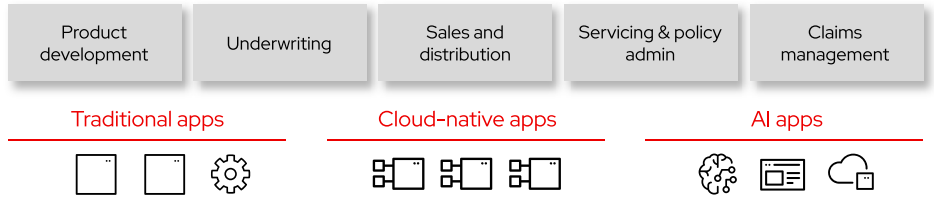

Insurers that adapt to these changes by using advanced technology and transforming company culture are better positioned for financial success. Change does not mean a complete overhaul. Finding a balance between traditional and modern systems is still transformative. To this end, a digital technology platform provides the ability to build, operate, and manage traditional applications alongside cloudnative and intelligent workloads using artificial intelligence and machine learning (AI/ML) functionalities.

A platform such as this gives insurers tools to rapidly innovate, automate processes, and deliver a personalized experience to their customers by using modern technology, such as generative AI (gen AI), and unlocking the true value of data.

Core system modernization

Help integrate new technologies and enhance agility, while reducing IT costs per policy by 41%, providing significant savings and operational efficiency over traditional systems.¹

Beyond reaction: A shift to a customer-centric insurance model

Traditional risk management models are insufficient for escalating global risks such as natural disasters, cybercrime, and financial instability due to high claim frequencies and severities. Climate change alone causes profound annual insurance losses, a cost that has doubled in the past 20 years.³ Senior leaders are proactively adopting advanced data analytics and technology from internal and external providers to prevent losses and protect their companies and policyholders.

To become proactive, insurers must undertake several transformation efforts, such as:

- Shifting focus to prevent losses that require unlocking data and breaking isolated structures. This helps insurers focus on preventive measures to mitigate losses before they occur.

- Integrating technologies such as AI to generate faster and better insights, improving the customer experience.

- Modernizing their technology foundation that underpins a complex set of digital services and business outcomes.

- Embracing cultural changes to achieve a customer-centric model, which promises increased operational efficiency, and enhanced customer satisfaction and loyalty. Failing to adapt can lead to losing competitiveness in a digital landscape with rising customer expectations.

Consequences of inaction limits future options

Insurance companies often face significant pressures to embrace digital modernization, so they can meet rising customer expectations and stay competitive. Maintaining outdated systems leads to rising costs and inefficiencies. Failure to modernize can lead to dire consequences, including regulatory scrutiny, financial strain, and dissatisfied customers.

Action does not guarantee success. Inefficient and complex technology operations can further exacerbate these issues. Insufficient security measures heighten the risk of cybersecurity breaches and data loss. Not taking a holistic approach is accepting the fate of living with complexity as part of your business.

Yet, the opportunity cost of failing to modernize is substantial. Investing in modern technology improves risk management, reduces costs, and creates new business opportunities, ensuring long-term profitability. Traditional systems hinder rapid development and deployment, making it difficult to meet market demands. Integrating these outdated systems with modern technologies is challenging and costly.

However, a modern digital platform for insurers is more than anything a single vendor can provide. It is a composition of systems, infrastructure, governance, and also the risk management framework that supports business processes. The challenge is that this solution made up of piecemeal parts needs to be certified to work in a unified way to reduce inefficiency, and protect the software supply chain.

Intelligent claims

Gen AI can reduce lossadjustment expenses by 20%-30% through efficient processing and fraud detection, and lower claims payouts by 3%-4%.⁴

Learn more about how Red Hat can help insurers implement intelligent workflow automation.

Insurers need to think of modernization as a unified strategy, incorporating systems, infrastructure, governance, and risk management into a single cohesive platform. This approach not only addresses the inefficiencies and costs associated with traditional systems, but also enhances competitive edge, customer satisfaction, and operational efficiency. By using technologies such as AI/ML and Internet of Things (IoT), insurers can provide proactive risk management and enhanced service levels, making sure all aspects of the business are aligned for profitability and sustainable growth.

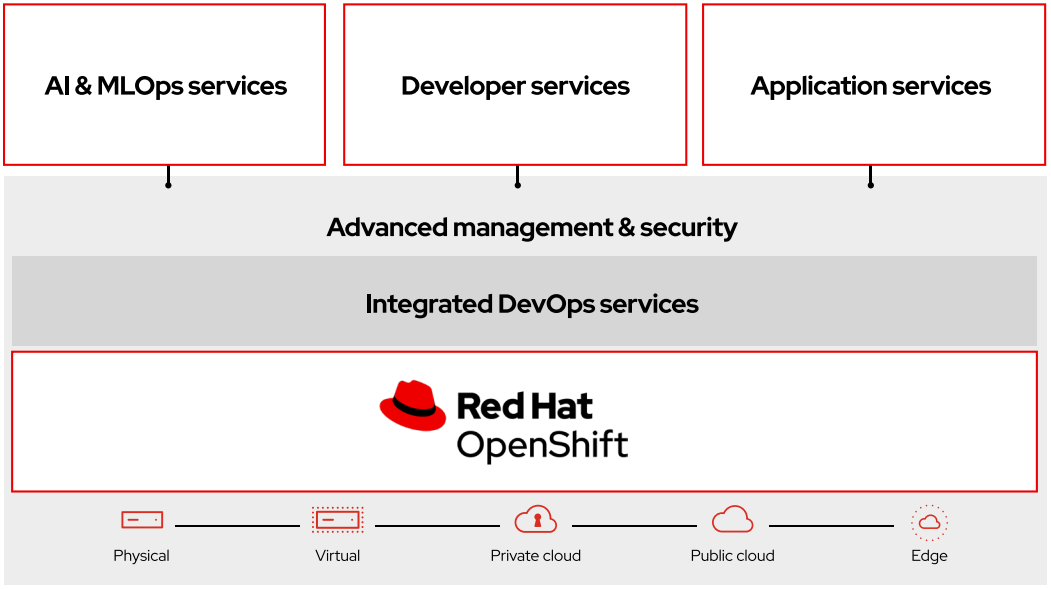

A modern, robust foundation for insurance digital technology platforms

For insurance companies facing these pressures, Red Hat offers various solutions to support transformation, helping insurers to use data more effectively, optimize operational costs, and enhance customer-centricity. These solutions help build a resilient, innovative ecosystem that meets regulatory requirements, enhances security, and delivers superior services to policyholders.

Connected insurance

Use data generated from IoT and remote devices to gather real-time insights, allowing proactive risk management, personalized services, and improved claims processing.

Smart underwriting

35% of underwriter working hours on responsibilities could be automated or delegated.⁵

Red Hat OpenShift

Red Hat® OpenShift® is the base application platform to modernize your digital environment. Red Hat OpenShift allows for both modern and traditional environments to exist on the same platform, reducing barriers to transitioning from traditional systems, or building new microservices next to monolithic workloads that are core to the business.

Red Hat OpenShift simplifies the orchestration and management of containers, allowing for deployment across diverse cloud infrastructures and giving insurers tools to remain flexible. This flexibility is crucial in adjusting to market demands and deploying new features that enhance customer engagement and loyalty. Additionally, Red Hat OpenShift’s development integrates automated workflows and continuous integration/continuous deployment (CI/CD) pipelines, reducing development time while enhancing consistency.

Red Hat OpenShift Virtualization

Red Hat OpenShift Virtualization integrates traditional virtual machines with a modern, container-based architecture, allowing these systems to operate concurrently. This integration facilitates a smooth transition from traditional systems to contemporary applications, a crucial strategy for insurers dedicated to modernizing their operations without disrupting existing workflows.

With many current virtualization solutions in fluctuation, OpenShift Virtualization can offer insurers the stability they are looking for.

Red Hat OpenShift AI

Red Hat OpenShift AI is a flexible, scalable AI and ML platform designed to empower insurance companies to efficiently develop and deploy AI-powered applications across hybrid cloud environments. The latest iteration of OpenShift AI introduces capabilities for serving predictive and gen AI models, enhancing the efficiency of data processing and model training.

Using open source technologies, OpenShift AI offers reliable, operationally consistent capabilities that help insurance teams to innovate, develop models, and roll out advanced applications that enhance customer experiences and streamline operations.

OpenShift AI facilitates processes such as data acquisition and preparation, model training and finetuning, and model deployment and monitoring. This includes specialized hardware acceleration to optimize performance. OpenShift AI supports a wide range of hardware and software configurations, providing the versatility needed to address unique challenges in the insurance sector.

Using OpenShift AI, Red Hat supports the integration of prevalent AI/ML tools and model serving technologies within the Red Hat OpenShift application platform, simplifying the technology stack for insurers. OpenShift AI builds upon the innovative work conducted in Red Hat’s Open Data Hub community project and other key open source initiatives such as Kubeflow, helping insurance companies access the latest AI capabilities without the complexity of managing them independently. This strategic support allows insurers to focus more on transforming customer interactions and optimizing risk management rather than managing the underlying technology infrastructure.

Red Hat Ansible Automation Platform

Red Hat Ansible® Automation Platform offers a comprehensive automation solution tailored for the insurance industry, combining necessary options for a security mindset, integrations, and scalability. The platform supports insurance companies in orchestrating crucial workflows and optimizing IT operations, a vital part of adopting and integrating enterprise AI effectively.

With the Red Hat Ansible Automation Platform, insurance companies can achieve several key objectives:

- Deliver consistent, reliable automation. Automate across different domains and use cases to simplify processes and reduce the potential for human error.

- Maximize existing technology and resources. Use existing investments more effectively, making sure that technology serves strategic business needs without unnecessary duplication of effort.

- Lay a strong foundation for AI adoption. Prepare the IT environment for a smooth integration of AI technologies, which are becoming increasingly important for advanced data analytics and personalized customer services in insurance.

Red Hat Developer Hub and Red Hat Trusted Software Supply Chain

The Red Hat Developer Hub offers insurers a powerful internal development platform (IDP) that centralizes and streamlines application development. It provides collaborative development environments equipped with the latest tools and frameworks, including Red Hat OpenShift Dev Spaces. In a modern context where supply chain vulnerabilities are more pronounced, the Red Hat Trusted Software Supply Chain emphasizes compliance through templates and best practices, playing a critical role in maintaining robust security standards.

Embedded insurance

US$ 70 billion the embedded insurance distribution in the U.S. could exceed this amount in premiums by 2030,⁶ driven by increased convenience and integration with non-insurance products, significantly expanding market reach and revenue potential.

Built on a proven platform

Red Hat Enterprise Linux® lays the groundwork for all of Red Hat’s offerings, providing a stable, security-focused, and high-performance operating system that supports a variety of Linux container hosts. Red Hat Enterprise Linux AI is a foundation model platform to develop, test, and run Granite family large language models (LLMs) for enterprise applications. Additionally, Red Hat Consulting is available to guide companies through the intricacies of implementing and optimizing these technologies.

Learn more

Begin your journey toward efficient and innovative insurance. By modernizing your digital technology platform with Red Hat and its valued partner ecosystem, you can navigate the complexities of modern risks, meet customer expectations, and achieve long-term success.

Krishnakanthan, Krish, et al. “IT modernization in insurance: Three paths to transformation.” McKinsey & Company, 19 July 2024.

Townsend, Christopher. “Re-writing the underwriting story: How to navigate the complexities of modern risks.” World Economic Forum, 16 Jan. 2024.

Murphy, Daniel. “How innovative financial solutions can build climate resilience.” World Economic Forum, 11 Jan. 2024.

Costa, Emanuele, and Nadine Moore. ”GenAI Will Write the Future of Insurance Claims.“ BCG, 13 Dec. 2023.

Bellizia, Nathalia, et al. ”The Underwriter of the Future: Balancing Art and Science to Drive Underwriting Excellence in Commercial Insurance.“ BCG, April 2023.

“Embedded Insurance Distribution Could Exceed $70 Billion in Premium in the U.S. by 2030.” PR Newswire, 11 Jan. 2023.